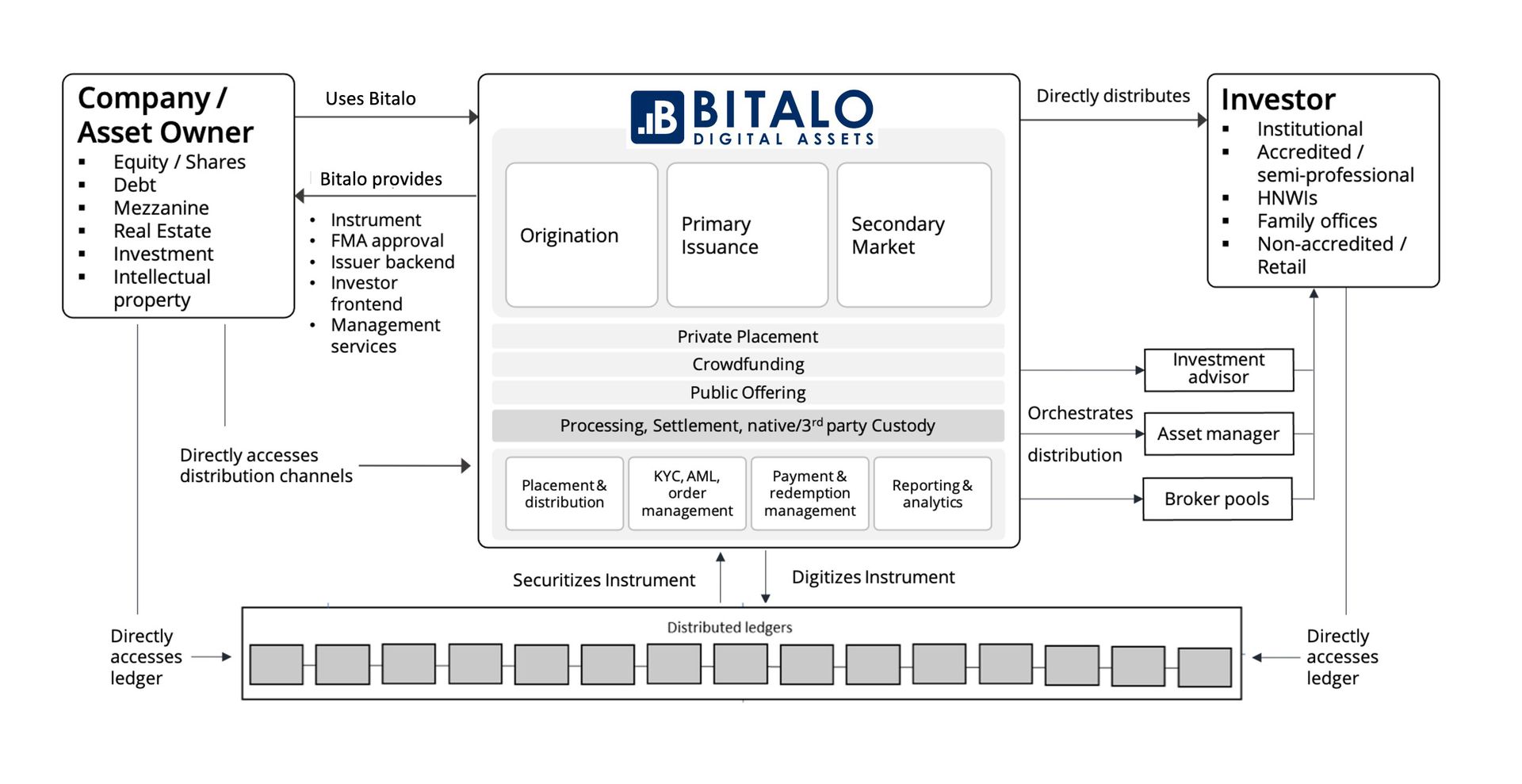

Digitale Unternehmensfinanzierung: Senkung der Kapitalkosten und Demokratisierung der Anlageoptionen

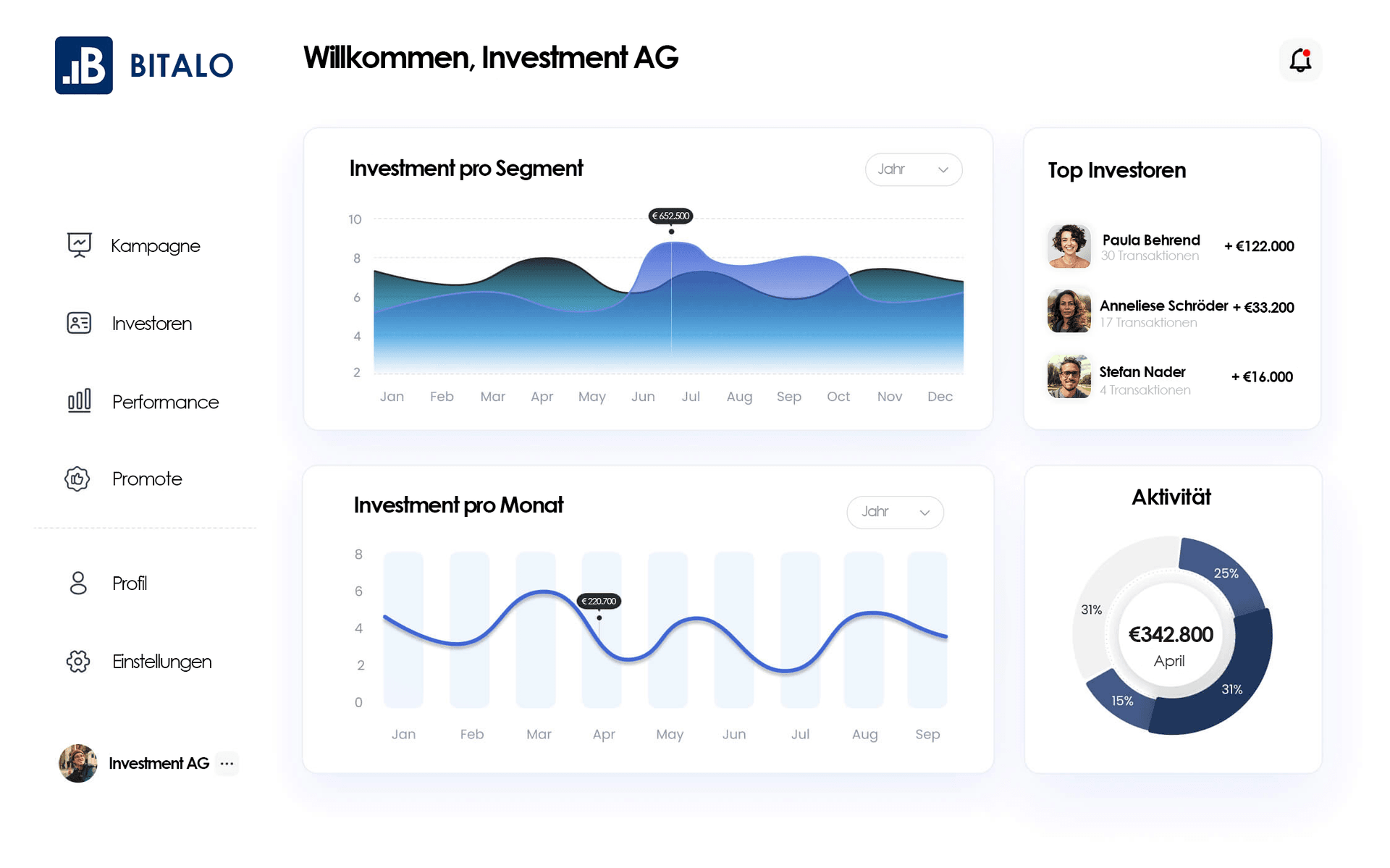

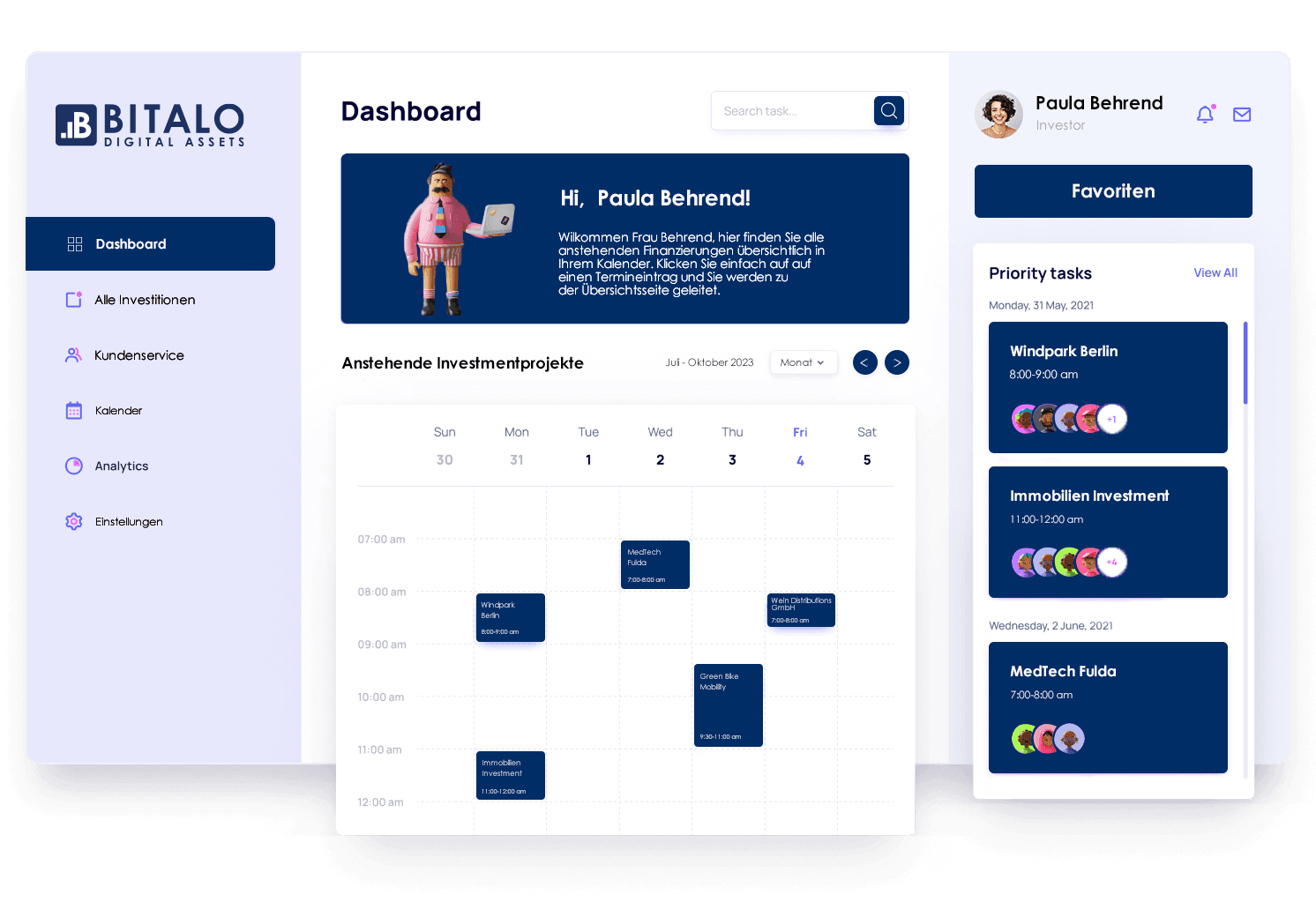

Digitale Unternehmensfinanzierung verändert die Art und Weise, wie Unternehmen Kapital beschaffen und Anleger investieren. Sie senkt nicht nur die effektiven Kapitalkosten, sondern ermöglicht auch die Ausschüttung höherer Rendite an die Anleger. Sowohl traditionelle als auch tokenisierte Wertpapiere können ausgegeben werden. Bitalo bietet eine nahtlose Abwicklung aus einer Hand. Darüber hinaus…