We connect companies and investors. Regulated in Germany.

Investors gain access to attractive capital investments. Companies receive growth capital. We build the bridge. Digital. Regulated. Secure.

Arrange appointment

Our partners:

Capital investments and corporate finance redefined.

Governance & Compliance

Every company undergoes rigorous due diligence. We ensure that business models are sustainable and economically profitable.

Public capital market

Companies, professional and private investors get access to the public capital market and fully digital settlement.

Attractive investments & returns

Investors and intermediaries gain access to attractive products. With our partners, we handle everything securely. Subscription, payment, allocation and repayment.

Direct investment

With our technology and connected intermediaries, companies get their financing quickly and easily.

Tradability through secondary market

As an investor, you can sell your capital investment on an integrated secondary market before maturity, giving you greater flexibility.

Private companies

As an investor, you gain access to public financing of innovative, audited and private companies, which were previously reserved for professional investors only.

What banks do not offer

- Available, holistic and flexible solutions for corporate financing

- Access to attractive capital investments before they are public

- Independent and international expertise

- Support from a single source throughout the entire process

- Traditional, innovative and digital financial products

Public financing on the financial market

Investment volume

Securitiesinformationsheet (WIB)

- Investment volume: 1,000,000 - 8,000,000 (WIB)

- Public

- Secondary market

- Range: National

The WIB is suitable for marketing to German investors and serves to inform investors about the relevant features and risks of a specific financial instrument or investment product. The WIB falls under the Markets in Financial Instruments Directive (MiFID II) and the EU Regulation on Packaged Retail Investment Products and Insurance Investment Products (PRIIPs).

20+ Experts

which are about Your capital investment, corporate financing and brokerage take care of. We accompany every step and ensure a safe, smooth process.

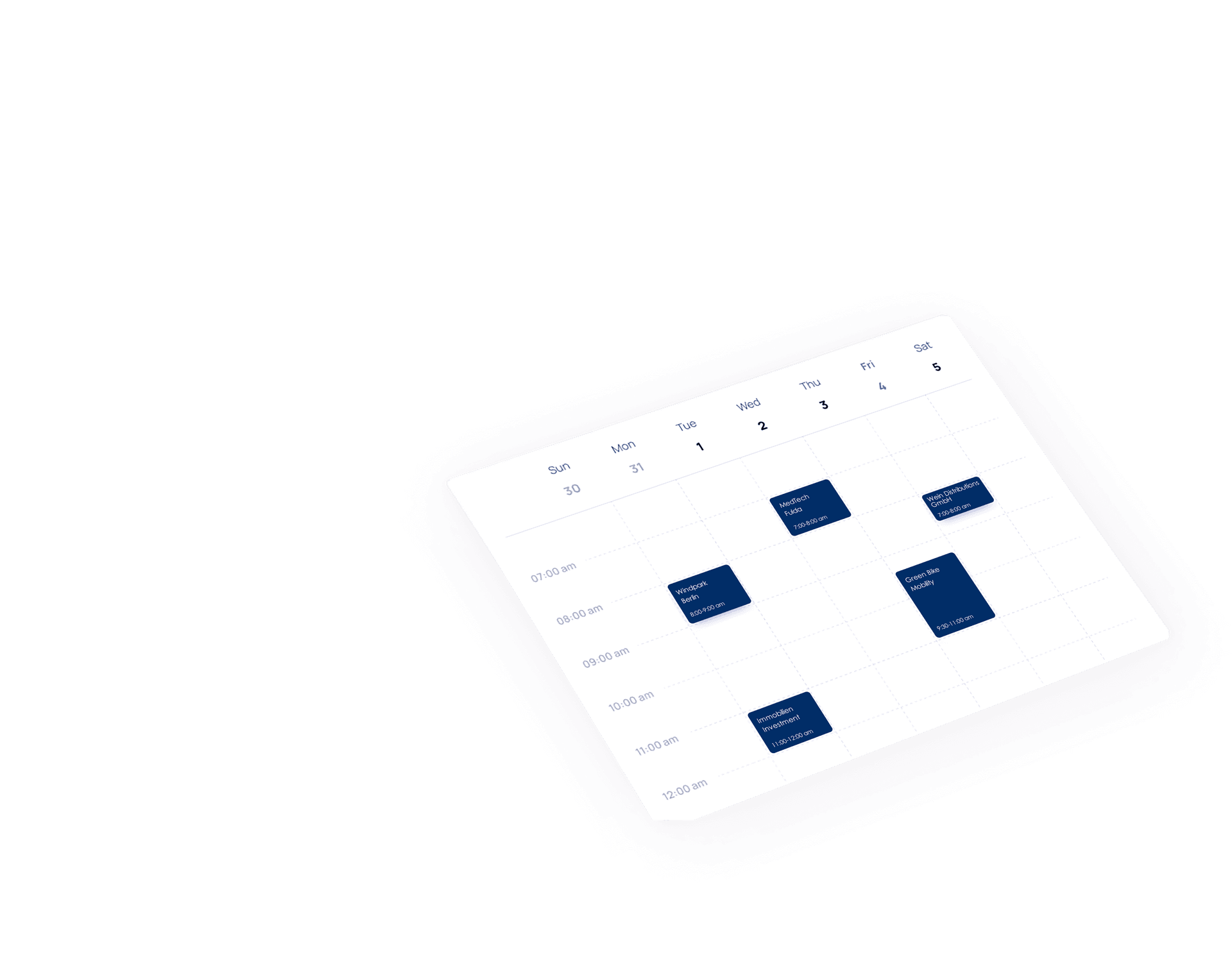

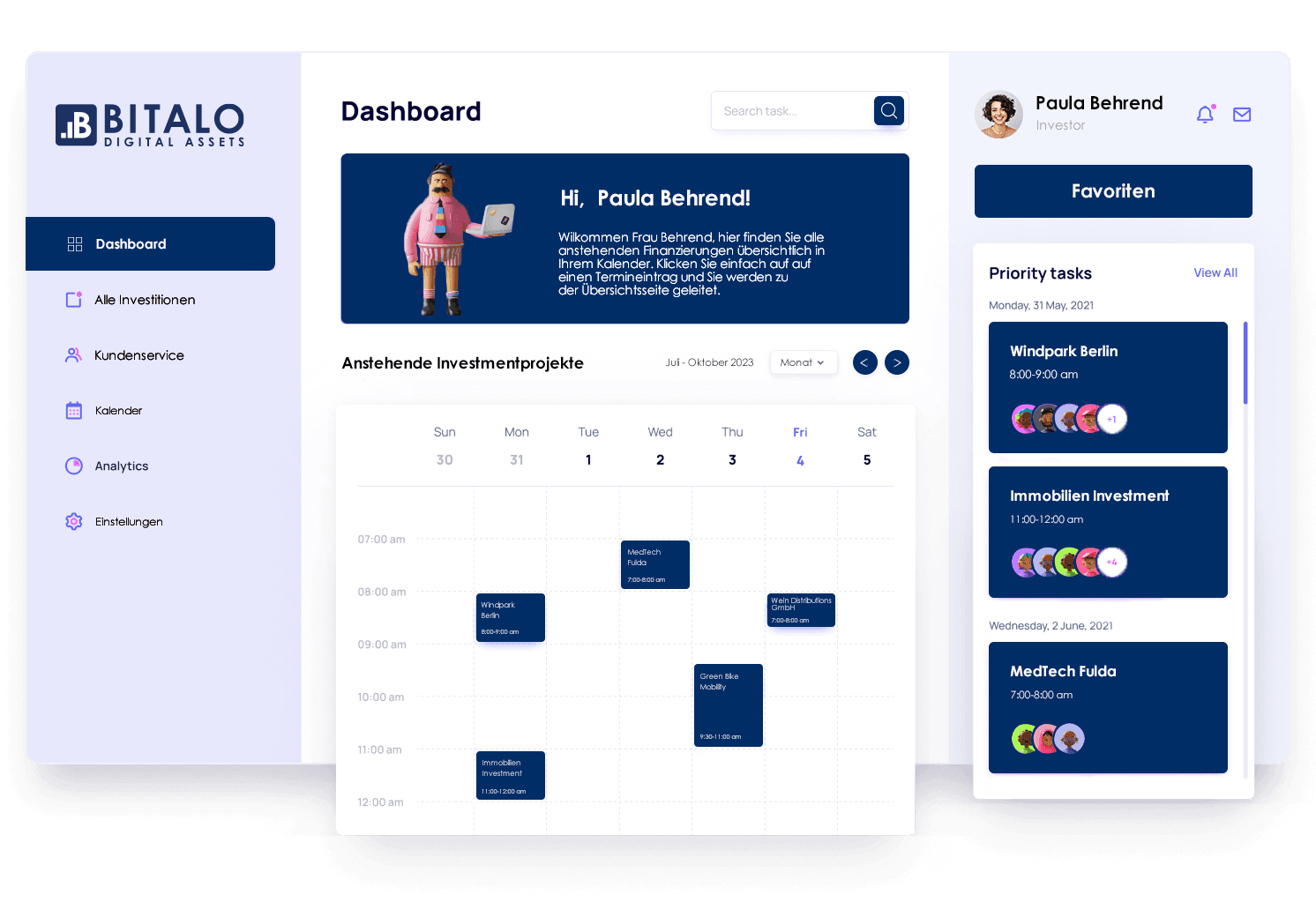

Platform features

Bitalo AG's end-to-end capital market platform enables companies to finance their projects and expansion - as an innovative alternative to the bank. Investors gain access to sustainable companies and products that meet all regulatory requirements.

Do you have any questions?

Take a look at our FAQs